Produkce mědi v Peru, třetím největším producentovi na světě, by měla letos mírně vzrůst na 2,8 milionu tun, zatímco investice do těžby by měly dosáhnout nejméně 4,8 miliardy dolarů, uvedl v úterý nejvyšší představitel peruánského těžebního průmyslu.

V roce 2024 Peru vyprodukovalo přibližně 2,7 milionu tun mědi a do klíčového těžebního sektoru přilákalo investice ve výši 4,96 miliardy dolarů.

Úředníci se také stále více zaměřují na nelegální těžbu zlata poté, co bylo v oblasti Pataz na severu Peru, která je bohatá na zlato, zabito 13 horníků, uvedl na tiskové konferenci ministr hornictví a energetiky Jorge Montero.

V posledních týdnech armáda a policie zničily nelegální doly a tunely v této oblasti, ale Montero uvedl, že oblast zůstává nebezpečná a vysoké ceny zlata podněcují nelegální činnost.

„Jedná se o dlouhodobý boj,“ řekl. „S cenami zlata nad 3 000 dolarů existuje obrovská motivace k nelegální těžbě.“

Zásah v Patazu znamená, že se nelegální těžba zlata zřejmě přesouvá do jiných oblastí, například do pohoří Cordillera del Condor na hranicích s Ekvádorem.

Vývoz zlata z Peru dosáhl v roce 2024 hodnoty 15,5 miliardy dolarů, což je nárůst oproti 11 miliardám dolarů v předchozím roce. Podle údajů z odvětví a peruánského finančního regulátora pochází přibližně 40 % vývozu zlata z Peru z nelegálních zdrojů.

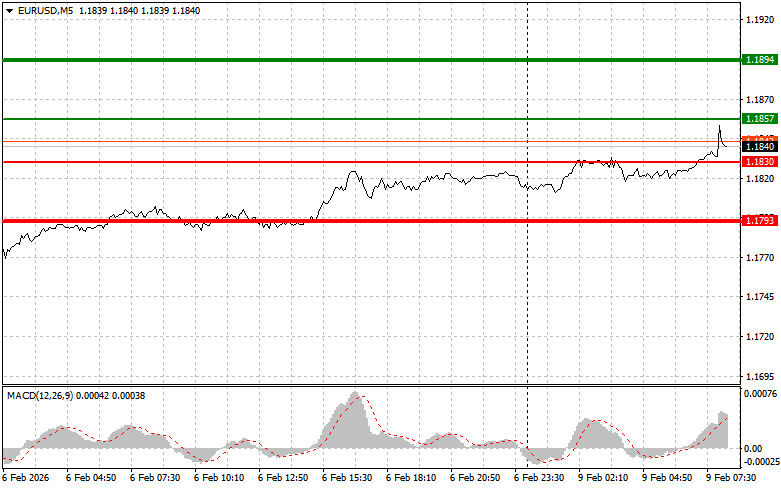

The test of the price at 1.1806 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the euro's upward potential. For this reason, I did not buy the euro.

Data from the University of Michigan on U.S. inflation expectations and speeches by Fed officials exerted slight pressure on the dollar at the end of last week. A decline in inflation expectations is often interpreted as a sign of slowing price growth in the economy. In such a situation, the Federal Reserve may reconsider its monetary policy, especially given ongoing challenges in the U.S. labor market. On one hand, slowing inflation can increase consumer purchasing power and reduce business costs. However, if the decline in prices is too rapid, it can signal a potential slowdown in economic growth or even the risk of deflation. Yet, considering the rapidly weakening American dollar recently, this risk appears unlikely.

Today, we are expecting the release of the Sentix Investor Confidence Index and a speech by the President of the Bundesbank, Joachim Nagel. The monthly Sentix survey among institutional investors is unlikely to significantly affect the volatility of the EUR/USD pair. However, a significant drop in the index may signal investor caution amid slowing economic growth. Concurrently with the release of the economic indicators, market participants will focus their attention on Joachim Nagel's speech. As the head of the central bank of the Eurozone's leading economy, his statements often signal potential future policies of the European Central Bank. Investors will closely examine his words for hints on possible changes in key interest rates. Any changes in the tone of his statements or indications of potential course adjustments may provoke significant market activity.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

LINKS RÁPIDOS