The labor market report confirmed the prevailing narrative in the market: trade in a way that benefits Donald Trump. In 2023–2024, discussions of American exceptionalism led to a rise in the dollar, which was accompanied by a surge in U.S. stock indices. At the beginning of 2025, the crowd followed the principle of "sell American." The US dollar declined in tandem with the S&P 500. Since May, their paths have diverged, with the U.S. President playing a key role.

During his first term, stock indices were Trump's benchmark of effectiveness as head of state. Nothing has changed since. Trump and his team take every opportunity to make bullish comments on the S&P 500. The most recent example was his social media announcement of a trade deal with Vietnam. Despite Vietnam agreeing to pay massive tariffs of 20–40%, investors continue to buy U.S. stocks.

The June U.S. employment report added fuel to the fire. The employment figure rose by 147,000, exceeding the forecasts of Bloomberg experts. Not a single analyst predicted a drop in the unemployment rate to 4.1%. These results signal the strength of the U.S. economy, support the ongoing S&P 500 rally, and allow the Federal Reserve to take a break until the end of the summer.

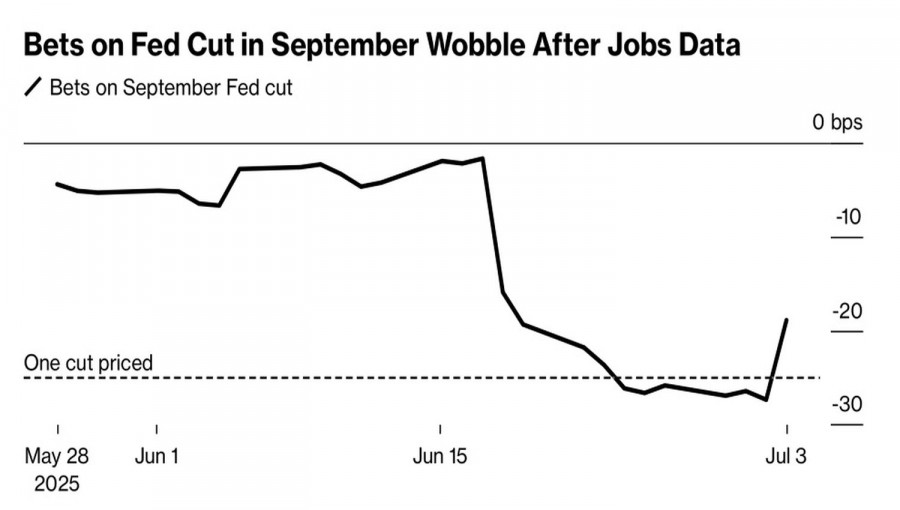

The futures market has almost completely stopped believing in a Fed rate cut in July — before the jobs report, the odds were 1 in 4. Derivatives pricing shows a lowered probability of monetary easing, allowing EUR/USD bears to counterattack.

However, the music for EUR/USD sellers didn't play for long. Investors remembered that Trump does not want a strong dollar. According to Deutsche Bank, to improve the current account balance to levels desired by the White House, a 30–35% depreciation of the U.S. dollar is needed. As a result, bulls bought the dip, just as the crowd consistently buys S&P 500 dips.

According to Morgan Stanley, the dollar index decline is merely in intermission, not the finale. Despite the worst first-half performance since 1973, the USD remains at historically high levels. The average EUR/USD exchange rate over the last two decades stands at 1.22. On Thursday, the pair traded several figures below that.

The Fed may wait until September to cut rates. However, other central banks have already ended their easing cycles or are nearing the end of theirs. The Fed, by contrast, is likely to resume monetary expansion, which is negative for the U.S. dollar.

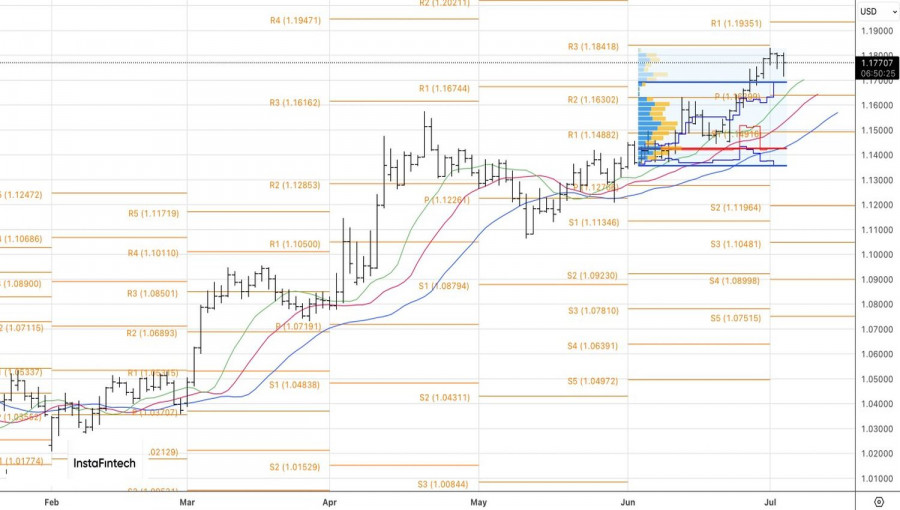

From a technical perspective, on the daily chart, EUR/USD shows an attempt by the bears to stage a counterattack. However, there's no reason to doubt the strength of the uptrend. A rebound from 1.1695 or a return above 1.1800 would signal the initiation of long positions on the euro against the U.S. dollar.

RÁPIDOS ENLACES