On Friday, the GBP/USD pair also ended its downward movement, which was merely a technical correction. After Jerome Powell's speech, which contained nothing that could have triggered a collapse of the dollar, the pair's quotes surged upward by 120 pips. For us, this outcome was not surprising, as we repeatedly warned traders — the uptrend remains intact, so the correction was expected to end with a new upward wave. The global fundamental backdrop has not changed; all the factors that pushed the dollar into decline in the first half of the year remain relevant. Therefore, with or without Powell, the dollar will continue to weaken. For dollar growth to be considered, either changes in the fundamental background or strong reversal signals on higher timeframes would be needed. In the UK, there were no important reports on Friday, and earlier macroeconomic data had not attracted much interest from traders either.

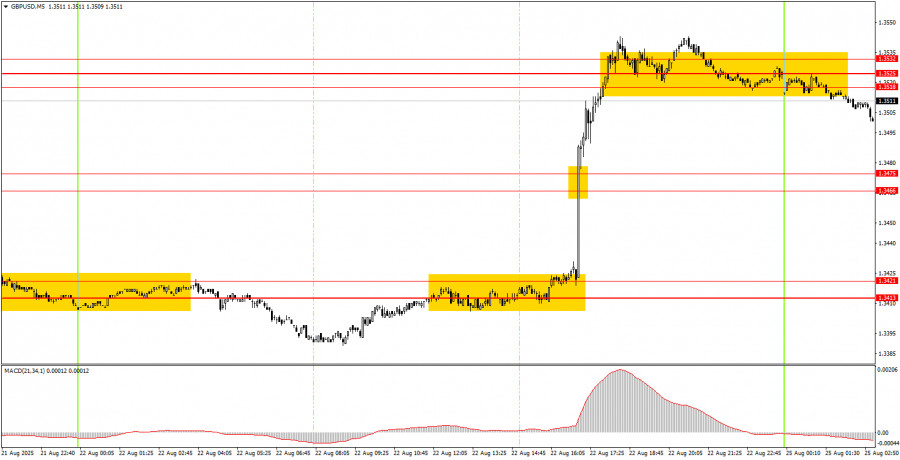

On the 5-minute timeframe on Friday, several trading signals formed. The first buy signal near the 1.3413–1.3421 area was generated precisely during Powell's speech, which made it nearly impossible to trade. However, just 5 minutes later, another buy signal appeared — a breakout of the 1.3466–1.3475 area, which traders could have managed to work through. After that, the price rose to the 1.3518–1.3532 area, where long positions could be closed in profit.

On the hourly timeframe, GBP/USD shows that the downward trend has ended, and a new upward trend is starting. The fundamental and macroeconomic background has not become any more favorable for the dollar recently to expect a stronger recovery. Thus, as before, we remain focused upward. Any news about escalation of the trade war, de-escalation of the Ukraine conflict, or Trump's pressure on the Fed will mean potential new declines for the U.S. currency.

On Monday, GBP/USD may well continue its upward movement, but new signals are now needed. Today, such signals could be a rebound from the 1.3466–1.3475 area or a breakout of the 1.3518–1.3532 area.

On the 5-minute timeframe, trading can now be done at the following levels: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3518–1.3532, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. No important events are scheduled in the U.S. or the UK for Monday, nor for the rest of the week. As a result, volatility may decline again.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

RÁPIDOS ENLACES