What's meant to happen will happen. EUR/USD has managed to revive its uptrend and is now heading toward 1.20. That's precisely where Goldman Sachs now sees the main currency pair. The bank has raised its 3-month forecast from 1.17 to 1.20, its 6-month forecast from 1.20 to 1.22, and projects that in 12 months, one euro will be worth $1.25. According to the bank, the euro is now leading the first stage of US dollar weakening. Later, the lead will pass to the Japanese yen and Chinese yuan.

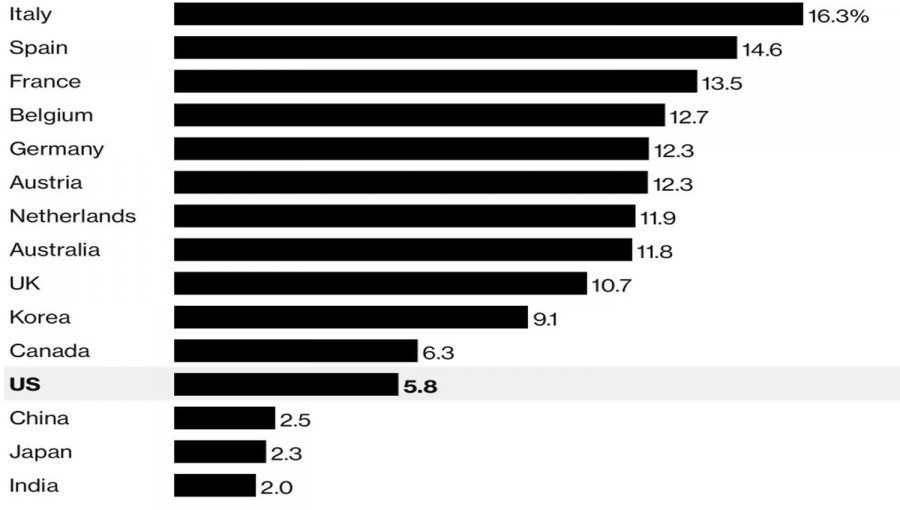

The foundation for the EUR/USD rally lies in divergences in economic growth and monetary policy. The cooling US labor market signals GDP deceleration. Meanwhile, increased spending on defense and infrastructure in the Eurozone and Germany will accelerate GDP growth in the currency bloc. And let's not forget Spain, which, thanks to migrants and tourism, is forecast by the government to grow by 2.7% in 2025. That's nearly identical to the Bank of Spain's estimate of 2.6%—more than twice the expected growth rate for the eurozone as a whole.

If the currency bloc provides positive surprises, the ECB may start considering an overnight rate hike next year, setting up further monetary policy divergence. According to futures markets, the Fed is expected to cut the federal funds rate by 150 basis points over the next 12 months.

The attractiveness of US Treasuries will continue to decrease—they are already losing to their European and Asian counterparts, which means capital could flow out of North America.

In practice, if there is a capital outflow, it's not yet major. Foreign investors are still buying US securities—especially stocks, given the S&P 500's record highs. At the same time, many are hedging currency risks by selling the US dollar. This keeps the greenback under constant pressure, along with the fundamental divergences in growth and monetary policy.

Trust in the "greenback" is also being undermined by Donald Trump's attacks on the Fed—criticizing Jerome Powell, attempting to fire Lisa Cook, and appointing Stephen Miran to the FOMC, all of which signal that the fight is only beginning. As a result, a sharp split within the central bank is expected already in September. Some members will vote for a 25 bp cut, some for 50 bp, and some may want to keep things unchanged. However, if there are more than three aggressive doves, the US dollar's decline could accelerate.

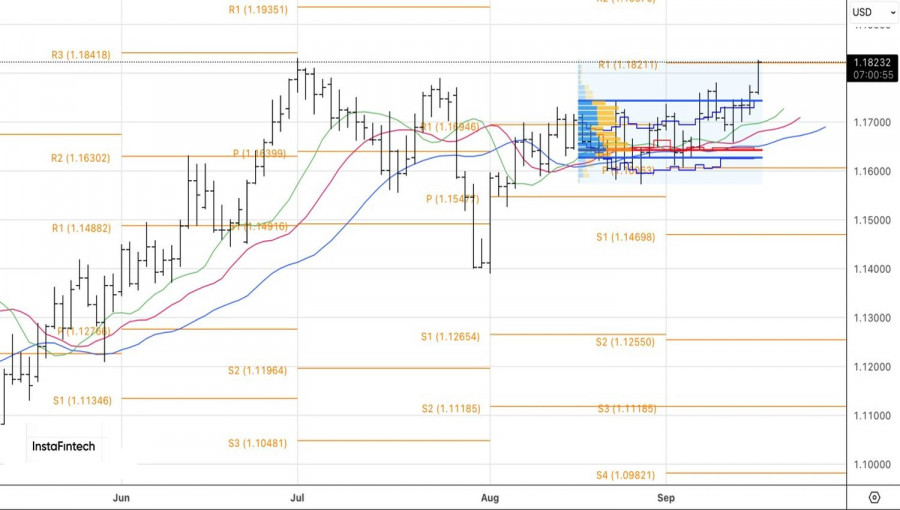

Technical view: On the daily chart, EUR/USD has broken out of a consolidation cage and has hit the first of two previously set targets at 1.184 and 1.195. The euro has managed to restore its uptrend, with new targets now coming into view—alongside 1.195, there's 1.220. In this environment, it's sensible to stick with the previous strategy: buy on pullbacks or on the breakout of resistances.

RÁPIDOS ENLACES