The euro has resumed its decline following the publication of the European Commission's report. According to the protocol data, the eurozone economy is expected to maintain moderate growth after overcoming the tariff shocks caused by Donald Trump better than anticipated.

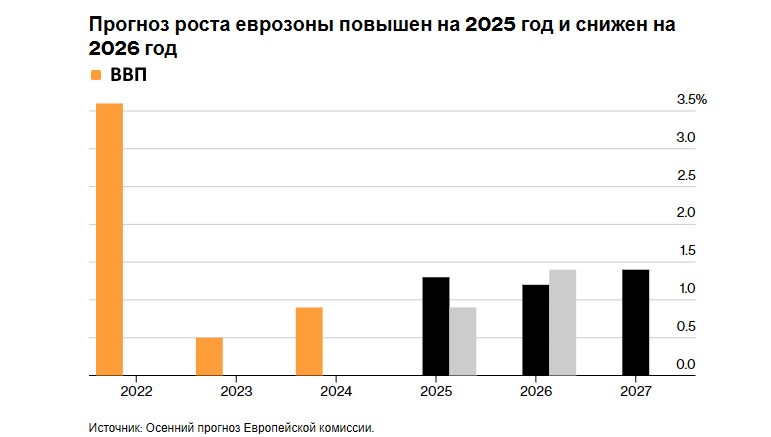

In its autumn report, the European Union's executive body noted that production is projected to grow by 1.3% in 2025 and by 1.2% in 2026. In 2027, growth is expected to be only 1.4%. This adjustment represents an upward revision for the current year compared to earlier forecasts in May and a slight downward adjustment for 2026.

Regarding inflation, it is expected to remain at 2.1% in 2025, as previously projected, and should stay close to the ECB's target of 2% over the following two years. However, officials warned that the 2027 figure does not account for the upward impact from the new carbon emissions pricing system.

European Commissioner for Economy Valdis Dombrovskis stated that the EU economy continued to grow even in unfavorable conditions. He emphasized that, given the complex external situation, the EU needs to take decisive action to stimulate internal growth.

It is important to note that these forecasts are more optimistic than the latest projections from the European Central Bank and the International Monetary Fund, while policymakers still maintain a more positive outlook for the upcoming months.

The Commission stated that recent high growth rates were driven by a sharp rise in exports earlier this year before tariffs were imposed, although investments also played a role. Despite the unstable global environment, economic growth is expected to be supported by increased government spending, private consumption, and a tight labor market, according to their statement.

However, significant concerns remain about the sustainability of this growth. In particular, the report emphasizes a slowdown in industrial production in Germany, which is a key indicator for the entire European economy. The plan by German Chancellor Friedrich Merz to spend hundreds of billions of euros on infrastructure and defense is expected to support GDP growth at 1.2% in both 2026 and 2027, compared to just 0.2% this year.

The European Central Bank also continues to maintain a wait-and-see approach, keeping interest rates unchanged after a favorable policy easing cycle. However, critics argue that this will not be sufficient to sustain current growth rates next year.

Meanwhile, France is facing political instability related to the budget. The Commission stated that the resulting uncertainty was likely to impact France's GDP the following year, although it was projected to grow by 0.9% compared to 0.7% in 2025.

Regarding budget outlooks, the Commission forecasts an increase in the overall budget deficit for the eurozone from 3.1% in 2024 to 3.4% in 2027, partially due to increased defense spending. As a result, debt levels could rise to just over 90% of GDP within two years.

As for the current technical picture of EUR/USD, buyers need to focus on reclaiming the 1.1625 level. Only then will it be possible to aim for a test of 1.1650. From there, the price could potentially reach 1.1680, but achieving this without support from major players will be challenging. The furthest target is around 1.1710. In the event of a decline, I expect significant activity from buyers around the 1.1590 level. If no buyers are present there, it would be prudent to wait for a new low at 1.1565 or to open long positions from 1.1540.

Regarding the current technical picture of GBP/USD, pound buyers need to overcome the nearest resistance at 1.3180. Only then will it be possible to target 1.3215, above which further upward movement will be quite challenging. The furthest target is around 1.3244. If the pair declines, bears will likely try to take control at the 1.3133 level. If successful, a break below this range would deal a significant blow to bull positions, pushing GBP/USD down to a minimum of 1.3085, with the potential to reach 1.3050.

TAUTAN CEPAT