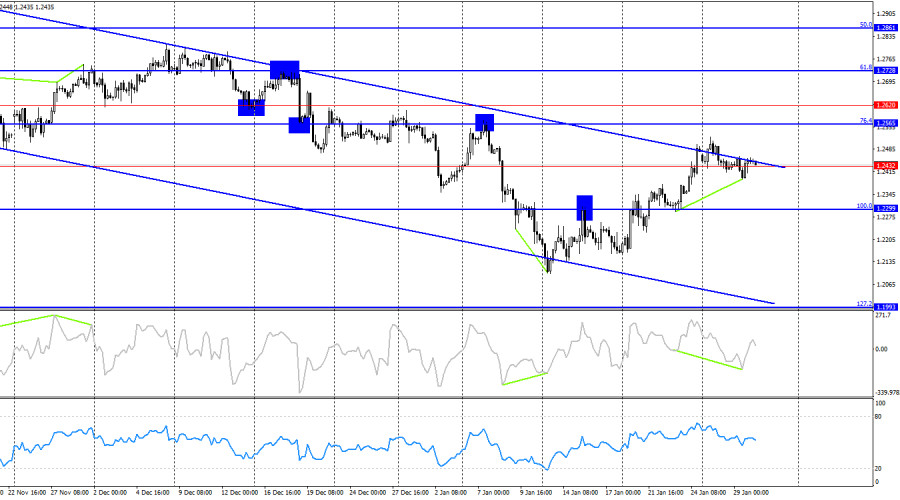

On the hourly chart, GBP/USD attempted to decline towards the 1.2363–1.2370 support zone on Wednesday but failed to sustain the move. Another attempt to test this level may follow today. Bulls still maintain some control, but they were unable to secure a breakout above the 1.2488–1.2508 resistance zone either. The upcoming Bank of England meeting next week remains a key factor for the pound, and until then, bulls must hold their ground within the upward channel.

The wave structure is clear. The last completed downward wave broke the previous low, while the latest upward wave has yet to reach the last peak. This suggests that the bearish trend remains intact. To reverse this trend, GBP/USD must rise to at least 1.2569 and secure a confident close above it. While this scenario is possible, discrepancies between the euro and the pound's wave structures indicate that one of them may be incorrectly formed.

Wednesday's market focus was not on the FOMC rate decision, as it was widely anticipated that the Fed would keep rates unchanged. Instead, all attention was on Jerome Powell's remarks. Powell reiterated that the U.S. economy remains strong and the labor market is balanced. The Fed is firmly committed to achieving its 2% inflation target, but rising CPI in recent months has prompted a more cautious stance. He emphasized that if the labor market shows signs of cooling, the Fed would be prepared to cut rates—but at present, such action is not necessary.

Additionally, Powell stated that Donald Trump will not influence the Fed's monetary policy, as he lacks the authority to do so. He also expressed concerns about potential U.S. tariffs and retaliatory measures, though it is too early to assess their impact. Given these statements, bears may have a stronger case for renewed selling pressure in the coming days.

On the 4-hour chart, GBP/USD remains within a downward trend channel. A rejection from the upper boundary of this channel could lead to a bearish reversal, targeting 1.2299 (100.0% Fibonacci level). However, if the pair breaks above this downward channel, it could force bears out of the market completely.

A bullish divergence has emerged on the CCI indicator, but bulls are yet to capitalize on this signal.

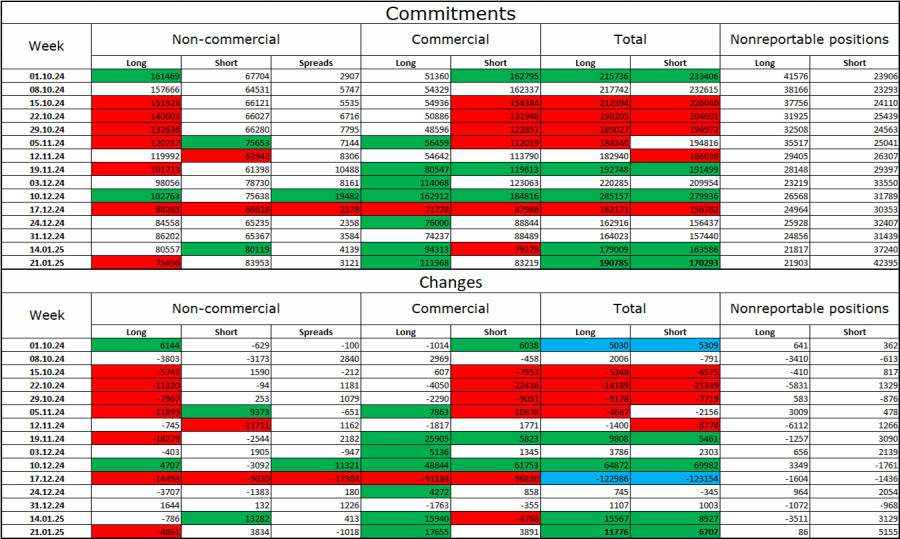

The latest COT report shows that speculative sentiment has become increasingly bearish. Non-commercial traders reduced their long positions by 4,861, while short positions increased by 3,834. Over the past several months, bulls have completely lost their market advantage. The gap between long and short positions is now 75,000 vs. 84,000 in favor of bears.

From my perspective, GBP/USD still has downward potential, with the COT report confirming the strengthening of bearish positions almost every week. Over the past three months, long positions have declined from 161,000 to 75,000, while short positions have risen from 67,000 to 84,000.

I believe institutional players will continue unwinding long positions or increasing shorts, as most bullish factors for GBP have already been priced in. While technical analysis currently suggests a possible rebound, corrections remain likely.

Thursday's economic calendar is relatively light, meaning the impact of fundamental events on market sentiment may be moderate.

Fibonacci retracement levels are drawn from 1.3000–1.3432 on the hourly chart and 1.2299–1.3432 on the 4-hour chart.