Akcie společností GEO Group (NYSE: GEO) a CoreCivic (NYSE: NYSE:CXW) stouply každá o 1 % po zprávě deníku New York Times (NYSE:NYT), že Trumpova administrativa hodlá vynaložit 45 miliard dolarů na výrazné rozšíření detenčních zařízení pro imigranty ve Spojených státech.

Zpráva, která vzešla z poptávky po nabídkách imigračního a celního úřadu ministerstva vnitřní bezpečnosti (ICE), nastiňuje ambiciózní plán pro dodavatele, kteří by měli poskytovat řadu služeb včetně nových detenčních zařízení, dopravy a zdravotnické podpory. Pokud by byl návrh financován, znamenalo by to dramatický nárůst výdajů, který by přesáhl 3,4 miliardy dolarů vyčleněných v minulém fiskálním roce na veškeré operace ICE v oblasti zadržování.

Tato zpráva měla pozitivní dopad na akcie společností GEO Group a CoreCivic, které provozují detenční centra. Společnost GEO Group zaznamenala v průběhu obchodní seance nárůst o 2,1 %, zatímco společnost CoreCivic vykázala rovněž zisky. Navrhované rozšíření je v souladu se závazkem prezidenta Trumpa k masovému tažení proti nelegální imigraci, což může vést k nárůstu poptávky po detenčních službách poskytovaných těmito společnostmi.

Rychlý nárůst cen akcií odráží očekávání investorů ohledně potenciálního zvýšení příjmů společností GEO Group i CoreCivic. V žádosti o předložení návrhů je uveden krátký termín, což naznačuje, že administrativa chce se svými plány naléhavě pokročit, což by mohlo vést k rychlému zadání a realizaci zakázek.

No need to panic. The market is simply cautious about the White House's return to the tariffs announced on America's Liberation Day. Donald Trump sent letters to various countries specifying import tariff rates. However, the US president also stated he remains open to negotiations. Investors are uncertain whether the proposed rates will be final. This uncertainty limits expectations of a deep correction in the S&P 500.

Back in early April, markets were rattled by the most aggressive White House tariff policy since the early 20th century. Three months later, the reaction has been more subdued. Derivatives on the S&P 500 are pricing in smaller fluctuations than those expected from the upcoming US inflation release or the July Fed meeting.

Expected S&P 500 volatility in response to key events

Markets are well aware of Donald Trump's strategy. His threats are followed by delays, and negotiations under pressure are intended to extract concessions for the United States. Yes, the White House has reignited a trade war, but it has also left the door open for a deal. The mere fact that tariffs will not increase in July can already be considered good news for the S&P 500. It wouldn't be surprising if retail investors soon rush in to buy the dip.

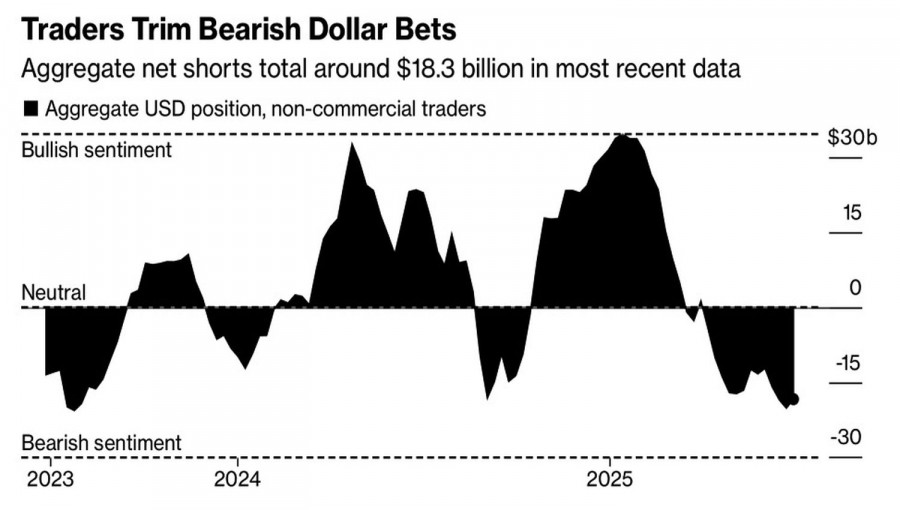

The broader equity index also faced headwinds from a stronger dollar and rising US Treasury yields. In April, investors feared for the future of US GDP and openly discussed recession risks. In July, sentiment has shifted — the economy is now expected to weather the storm. As a result, speculative short positions on the greenback are beginning to look overstretched, making a correction in the US dollar index increasingly likely.

Net position dynamics for USD

A stronger US dollar is squeezing profits for American companies operating overseas. Rising Treasury yields are also pushing up their financing costs. Weaker corporate earnings provide a strong argument in favor of S&P 500 selling pressure.

The broad index's slide was further exacerbated by a sharp decline in Tesla shares. Elon Musk announced the creation of a new political party, while Donald Trump criticized the world's richest man for the move.

Overall, the return of substatial tariffs cannot be considered an outright escalation of the trade war. New rounds of negotiations and potential trade deals will likely reduce the final import tariff rates. The S&P 500 managed to recover after the turmoil on America's Liberation Day and even notched a few new record highs. So why shouldn't the broad equity index climb even higher?

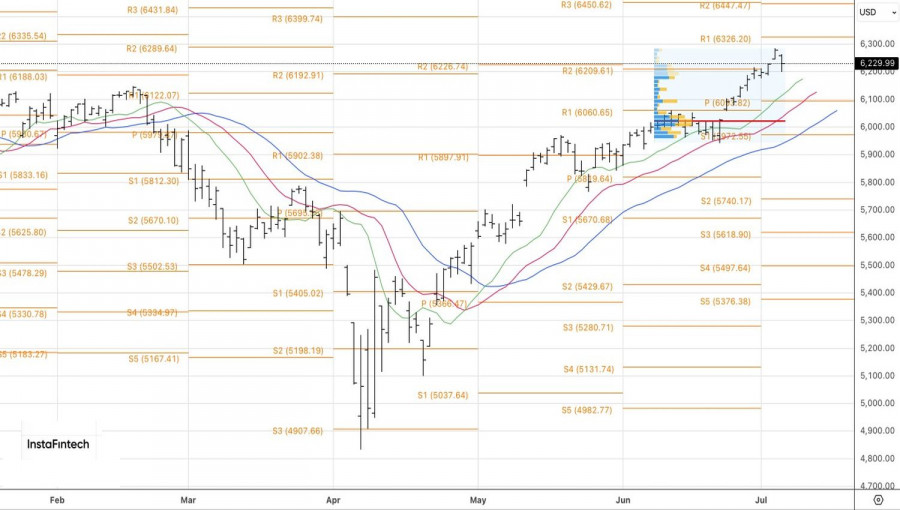

Technically, the S&P 500 pulled back toward the upward trendline on the daily chart, returning to a key support level at the pivot point of 6,210. Bears' inability to break below this threshold signals weakness among US equity sellers. The rebound in the broad index allowed traders to build on long positions initiated from 6,051. These positions are worth holding.