Kanadská vláda oznámila, že udělí výjimku z dovozních cel na určité automobily vyrobené v USA, a to za předpokladu, že automobilky nadále zachovají výrobu vozidel na území Kanady. Tato politika by měla ulevit společnostem jako General Motors Co. a Stellantis NV, které mají montážní závody v provincii Ontario, ale zároveň dovážejí značné množství vozů ze Spojených států.

Oznámení přichází poté, co vláda premiéra Marka Carneyho minulý týden zavedla odvetná cla na automobily vyrobené v USA. Nová politika rovněž zahrnuje šestiměsíční odklad cel na americké dovozy, které jsou využívány v kanadské výrobě, zpracovatelském průmyslu, balení potravin a nápojů, a také na některé položky související s veřejným zdravím a cíli národní bezpečnosti.

V současnosti Kanada uplatňuje 25% odvetná cla na zboží z USA v hodnotě přibližně 60 miliard kanadských dolarů (43,3 miliardy amerických dolarů), včetně další sady cel na některé americké automobily. Tato cla se vztahují na široké spektrum amerických produktů ze železa a hliníku, stejně jako na nástroje, počítače a spotřební zboží.

Výjimky mají podpořit kanadské podniky, které jsou závislé na dovozech z USA, aby si udržely konkurenceschopnost. Tato opatření budou mít rovněž pozitivní dopad na klíčové instituce jako jsou nemocnice, zařízení dlouhodobé péče a hasičské sbory, uvedlo kanadské ministerstvo financí ve svém prohlášení.

The price of gold stabilized after posting its strongest two-month gain last Friday, as traders assessed the implications of weak U.S. employment data for the economy and the Federal Reserve's interest rate trajectory.

The unexpectedly soft jobs report, which showed a slowdown in hiring, prompted market participants to revise their expectations regarding future Fed policy. The reduced likelihood of rates remaining elevated supported gold, which is traditionally viewed as a safe-haven asset during periods of economic uncertainty and inflation. In the near term, gold will remain sensitive to incoming economic data, particularly inflation and labor market indicators. Any further signs of a U.S. economic slowdown could push the Fed toward a more accommodative stance, providing additional support for gold prices.

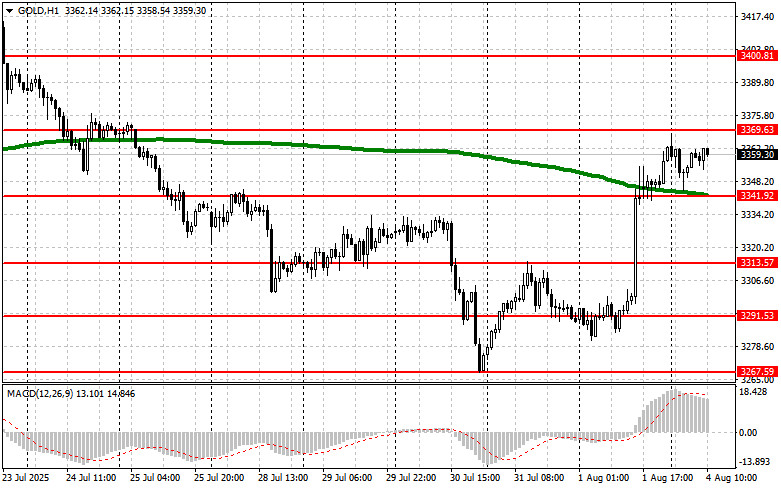

Spot gold reached around 3,360 dollars per ounce after a 2.2% increase. As mentioned above, the rally in the precious metal was driven by two main factors: the sharp slowdown in U.S. job growth, which increased bets on rate cuts, and President Donald Trump's introduction of some of the highest trade tariffs since the 1930s.

The U.S. Bureau of Labor Statistics reported on Friday that only 73,000 new jobs were created in July, while figures for the previous two months were revised down by nearly 260,000. Trump also dismissed the head of the bureau just hours after the release of the report, triggering a market sell-off.

Gold has already risen more than 25% this year, as Trump's unpredictable policies and geopolitical tensions in other parts of the world continue to fuel demand for safe-haven assets. Investors and analysts are forecasting further gains, supported by ongoing central bank purchases and the possibility of rate cuts.

Technical Outlook for Gold Buyers now need to break through the nearest resistance at 3,369 dollars. This would open the way toward the 3,400 level, although breaking above that level will be quite difficult. The furthest target is the 3,444 level. If gold declines, bears will try to regain control at 3,341. A break of that range would deal a significant blow to bullish positions and push gold toward the 3,313 low, with the potential to reach 3,291.