There are virtually no macroeconomic reports scheduled for Monday. Of course, you could mention the business activity indices in the manufacturing sectors of Germany, the EU, and the US (second estimates for August), but we remind novice traders that second estimates usually do not differ from the first ones. The market values the initial readings of indicators for a given month.

Among the key events on Monday is the speech by European Central Bank President Christine Lagarde, which is scheduled to take place in the evening. Thus, nothing will influence market sentiment during the day. There are no expectations for any important statements from Lagarde today. There are currently no questions regarding ECB monetary policy. The easing cycle is practically complete. At most, you might expect one more key rate cut if Eurozone inflation continues to slow. However, the latest report on German inflation showed an increase to 2.2%, so a rise in the overall Eurozone figure is more likely. In any case, the euro has not faced any issues in 2025 due to the ECB rate cut. However, the dollar could start facing serious problems because of future Federal Reserve rate cuts.

One of the main factors for traders remains the trade war. Since there are no signs of de-escalation, the market has no reason for medium-term purchases of the dollar. Last week, Donald Trump increased tariffs to 50% for India. As before, the US currency may count on local growth based on technical factors or isolated events/reports, but nothing more.

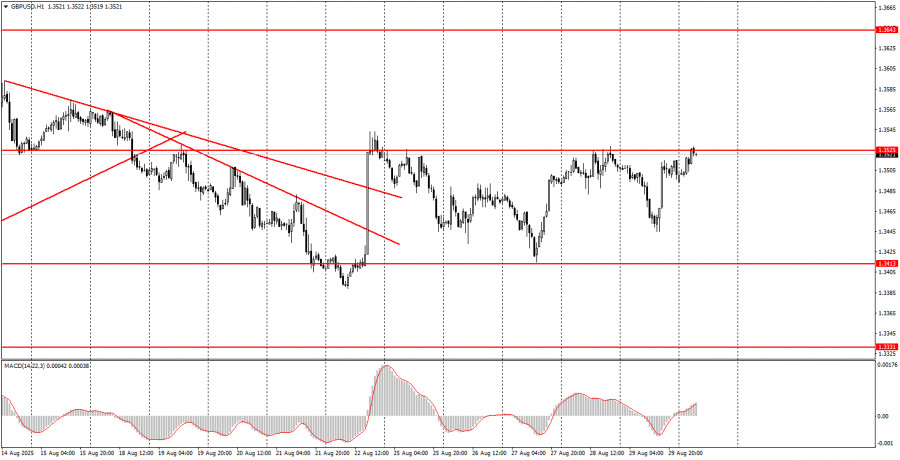

On the first trading day of the week, both currency pairs will again be trading based on technical factors. The euro may continue to rise after bouncing from the 1.1655–1.1666 area, targeting the 1.1740–1.1750 range. The pound sterling may bounce again from the 1.3518–1.3532 area and remain flat, allowing novice traders to open short positions targeting 1.3466–1.3475. Market volatility remains low.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.