On Wednesday, the GBP/USD currency pair began the day with a sharp drop to the 1.3307 level. However, in the second half of the session, traders regained composure and stopped selling the pound. The UK inflation report was released in the morning, marking the first somewhat notable macro release of the week. Since inflation came in below expectations, the pound understandably declined — dovish expectations toward the Bank of England's monetary policy surged immediately.

However, this was the only valid fundamental reason for the pound's decline this week. In the second half of the day, the pound rallied significantly, despite its previous fall on earlier days without any fundamental justification. As previously mentioned, market logic appears limited right now, and a flat on the daily time frame remains in play.

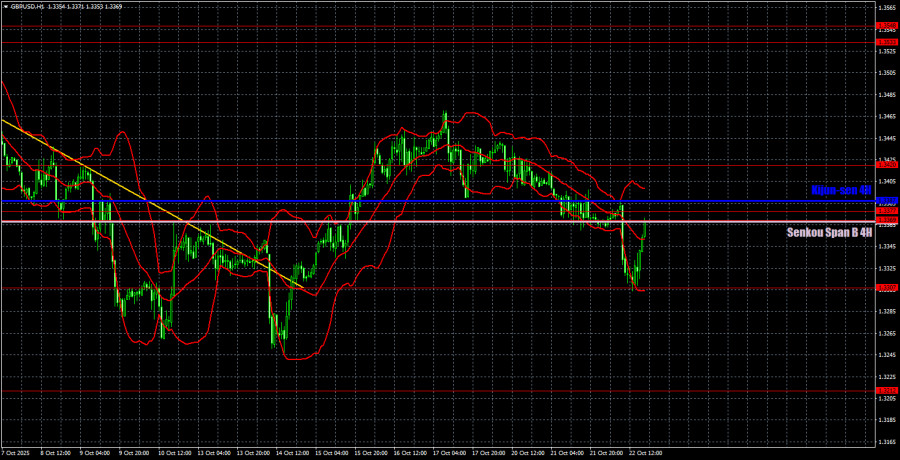

From a technical perspective, GBP/USD has initiated what appears to be a new upward trend, though it remains below the Ichimoku indicator lines. To confirm this new trend, a breakout and consolidation above the Senkou Span B and Kijun-sen lines is required. A rejection from these levels could lead to another wave of unjustified downside.

On the 5-minute chart, three strong signals formed yesterday. During the European session, under macro pressure, the price broke below the 1.3369–1.3377 zone and the Senkou Span B line. A few hours later, the pair reached the target level of 1.3307, allowing traders to gain approximately 30 pips on a short position.

A double bounce off 1.3307 triggered a reversal back toward 1.3369–1.3377. This buy signal was also tradable with an additional profit of roughly 50 pips.

COT (Commitment of Traders) data for the British pound indicates that commercial traders' sentiment has been inconsistent in recent years. The red and blue lines (representing the net positions of commercial and non-commercial traders) cross each other frequently and generally hover near the zero mark, signaling a roughly equal distribution of buy and sell positions.

Currently, the weakening of the U.S. dollar is primarily driven by Donald Trump's policies, making market-maker demand for the pound less relevant in the short term. The trade war is expected to persist in one form or another, and the Fed is likely to continue easing over the coming year. Demand for the dollar is falling as a result.

According to the latest report, the "Non-commercial" group opened 3,700 new long contracts and closed 900 short contracts. As a result, net long positioning rose by 4,600 contracts for the week.

While the pound has risen sharply in 2025, the main driver remains U.S. policy. Until this changes, the dollar is likely to stay on the defensive. Whether or not pound net positioning increases or decreases, it's the dollar side of the equation that's pulling the pair higher — and at a faster pace.

On the hourly chart, GBP/USD has completed its downward trend and shifted back into a rising one. With few fundamental reasons to support a strong U.S. dollar, we expect the pair to continue moving toward its 2025 highs. The main caveat would be the continuation of the broader flat on the daily chart, which could delay the bullish trend. However, current conditions suggest a persistently dovish Fed and further escalation in the U.S.–China trade war — a volatile combination that remains negative for the dollar.

Important trading levels for October 23: 1.3125, 1.3212, 1.3307, 1.3369–1.3377, 1.3420, 1.3533–1.3548, 1.3584, 1.3681, 1.3763, 1.3833, 1.3886. Additionally, key Ichimoku levels to monitor: Senkou Span B (1.3368) and Kijun-sen (1.3387). Ichimoku levels may shift throughout the trading day, so updates may be required. Use breakeven stop-loss orders after a move of 20+ pips in the favorable direction to mitigate risk.

No significant economic data is scheduled on Thursday from either the UK or the U.S., which may lead to reduced volatility. Intraday trading will need to rely strictly on technical setups.

Today, traders can once again trade from the 1.3369-1.3377 area and the Senkou Span B line. The British pound has begun an upward trend, so in the short term, we expect this movement to continue with a target of 1.3533-1.3548. For longs, it is necessary to break through the 1.3369-1.3377 area and, preferably, the Ichimoku indicator lines. For shorts, a rebound from the 1.3369-1.3377 area is required.