The test of the 1.1606 price level coincided with the moment when the MACD indicator began moving upward from the zero line, confirming the correct entry point for buying the euro. As a result, the rise amounted to more than 100 points.

Following his speech in Jackson Hole, Federal Reserve Chair Jerome Powell unequivocally stated plans to lower interest rates in September of this year. This statement triggered a significant decline in the U.S. dollar and, consequently, strengthened the euro's position. Market participants interpreted this step as the beginning of a new phase in monetary policy aimed at supporting and stimulating economic activity. Most likely, this Fed decision is driven by concerns over slowing U.S. economic growth and persistent global economic instability. Lowering rates aims to make borrowing more affordable for businesses and individuals, which in turn should boost investment and consumer demand. However, rate cuts carry certain risks. In particular, they may lead to higher inflation and reduced dollar purchasing power. Additionally, there is a risk of capital outflows from the U.S. to countries with more attractive interest rates.

Today, the euro's direction will be determined by IFO data, which includes the business climate index, the current situation assessment, and Germany's economic expectations index. The business climate index, being a composite indicator, reflects the overall sentiment of the German business community. Its growth indicates optimism and confidence in the outlook, typically supporting the euro. The current situation assessment shows how companies evaluate their present conditions. A positive reading also serves as a supportive signal for the euro, confirming the stability of the German economy. Finally, the economic expectations index reflects business forecasts for the next six months. Optimistic expectations encourage investment and business activity, which may further strengthen the euro. Thus, today's IFO data release will serve as an important guide for traders and investors. Encouraging results indicating positive trends in the German economy are likely to support euro growth, while weak figures may trigger selling and lead to a decline in the single currency.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

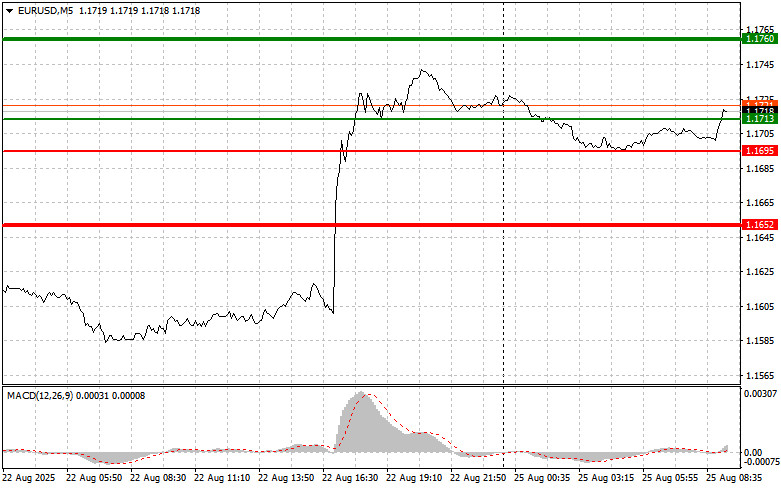

Scenario No. 1: Today, I plan to buy the euro at the entry point around 1.1713 (green line on the chart) with a target of 1.1760. At 1.1760, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35-point pullback from the entry point. Buying the euro should only be considered after very strong data. Important! Before buying, ensure the MACD indicator is above the zero line and is just starting its upward move.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1695 price level at the moment when the MACD indicator is in oversold territory. This will limit the pair's downside potential and trigger a reversal upward. Growth toward the opposite levels of 1.1713 and 1.1760 can be expected.

Scenario No. 1: I plan to sell the euro after reaching the 1.1695 level (red line on the chart). The target will be 1.1652, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25-point rebound from the level). Pressure on the pair will return today in the case of weak data. Important! Before selling, ensure the MACD indicator is below the zero line and is just starting its downward move.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1713 price level at the moment when the MACD indicator is in overbought territory. This will limit the pair's upside potential and trigger a reversal downward. A decline toward the opposite levels of 1.1695 and 1.1652 can be expected.

RÁPIDOS ENLACES