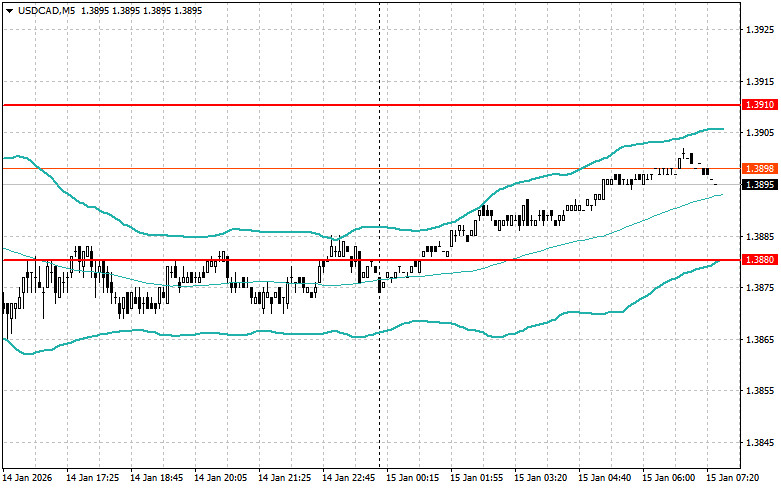

The dollar continued to rise against a number of risk assets after another round of US inflation data.

US Producer Price Index data for November last year supported the dollar, driving EUR/USD lower. The PPI increased by 0.2% month-on-month, exceeding analysts' expectations of a 0.1% rise. The annual figure also beat forecasts, coming in at 3.0%. These data indicate that inflationary pressure in the US economy remains persistent, which in turn may prompt the Federal Reserve to maintain a cautious monetary policy.

Today market participants will focus on a new set of economic indicators from Europe, which have been scarce recently. Special attention will be paid to the release of France's consumer price index, an important barometer of inflationary pressure in the eurozone's second-largest economy. A CPI print above forecasts could indicate persistent inflation and thus support the euro. The industrial production change in the eurozone will also attract interest. This indicator reflects real-sector dynamics and serves as a gauge of overall economic activity. A substantial increase in industrial production could signal a recovery in the eurozone economy and strengthen the euro. The trade balance result is also an important indicator, characterizing the eurozone's competitiveness on the world market. A positive balance indicates exports exceed imports, which supports the national currency.

Finally, the European Central Bank's economic bulletin will provide market participants with a deeper analysis of the current economic situation in the eurozone and monetary policy prospects. Traders will also pay attention to ECB projections.

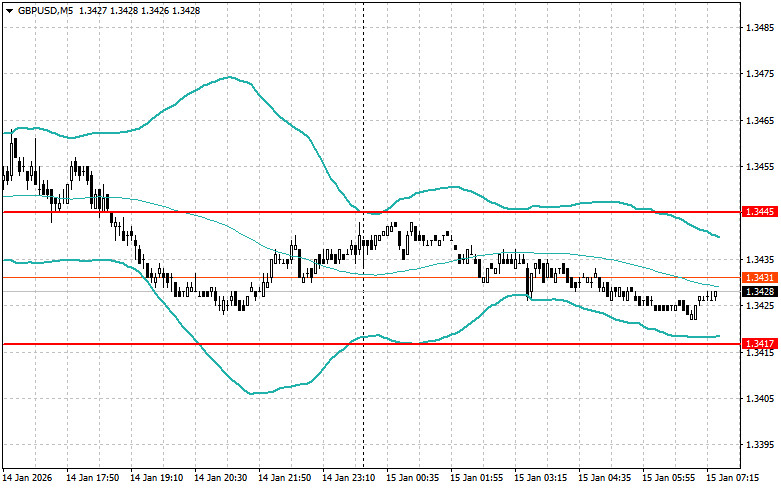

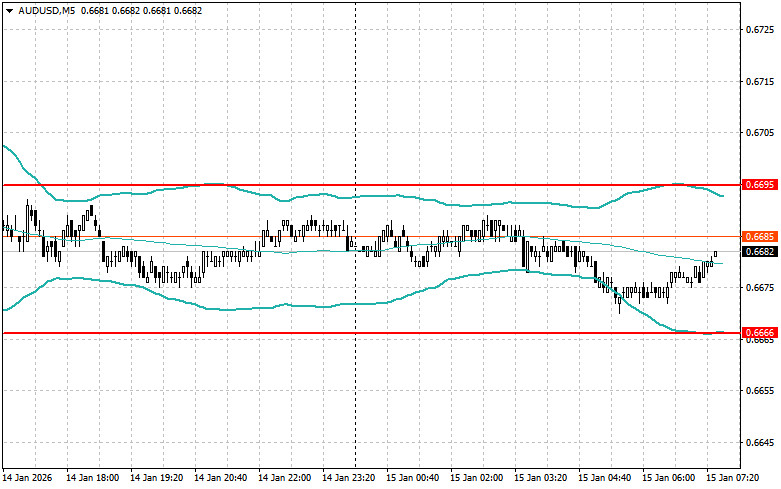

If the data match economists' expectations, it is better to act using a Mean Reversion strategy. If the data are much higher or lower than expectations, it is best to use a Momentum strategy.

RÁPIDOS ENLACES