Investors became skillful at buying S&P 500 dips in 2025. Hence, when gold plunged at the fastest pace since 1980 they seized the chance. As a result, the metal posted its best single?day performance since 2009 in the very next session — a period when gold was aggressively bought as a safe haven amid the global financial crisis.

The comparison with stock indices is no coincidence. In the 1980s, the Dow outpaced gold by a factor of about 1.3. At the peak of the dot?com crisis, the ratio was 42 to 1. Today, that ratio stands at roughly 10 to 1, which makes gold relatively inexpensive versus the US stock market. That's the reason why optimism about a resumed XAU/USD uptrend hasn't faded.

Bulls argue that despite the dramatic sell?off, the fundamental drivers of the gold rally remain intact. Political and geopolitical tensions are high, central banks are still actively buying bullion, and Kevin Warsh's confirmation by Congress as Fed chair does not mean the Fed's independence issues or the loss of confidence in the US dollar have been resolved.

Therefore, no wonder that Deutsche Bank reaffirms its forecast for gold to rise to $6,000/oz in 2026. Goldman Sachs admits the odds are that the real price could overshoot its target of $5,400. Fidelity, which sold gold before its plunge, is now seeking opportunities to buy.

Gold volatility dynamics

However, not all experts are bullish. Bank of America highlights the persistence of high volatility in the precious metals market. In its view, the bubble has popped, but speculators remain — and the XAU/USD rally may simply be inflating a new bubble.

Time will tell who is right. If Deutsche Bank and Goldman Sachs are correct, the uptrend will be restored. If Bank of America is right, the metal may be at the start of a multi?year bear phase like the one that began in 2011.

In my view, markets overreacted emotionally to President Trump's selection of Kevin Warsh as the new Fed chair. Warsh — a former FOMC policymaker — appeared to investors as the most "hawkish" candidate, yet he insists on cutting the federal funds rate. That's bad news for the dollar and good news for gold.

As long as Donald Trump remains in office, uncertainty won't disappear, and demand for safe havens will stay high. The key is that XAU/USD must not resume the blistering speed of January's rise, which would be a sign of speculative excess. And bubbles, as we know, burst sooner or later.

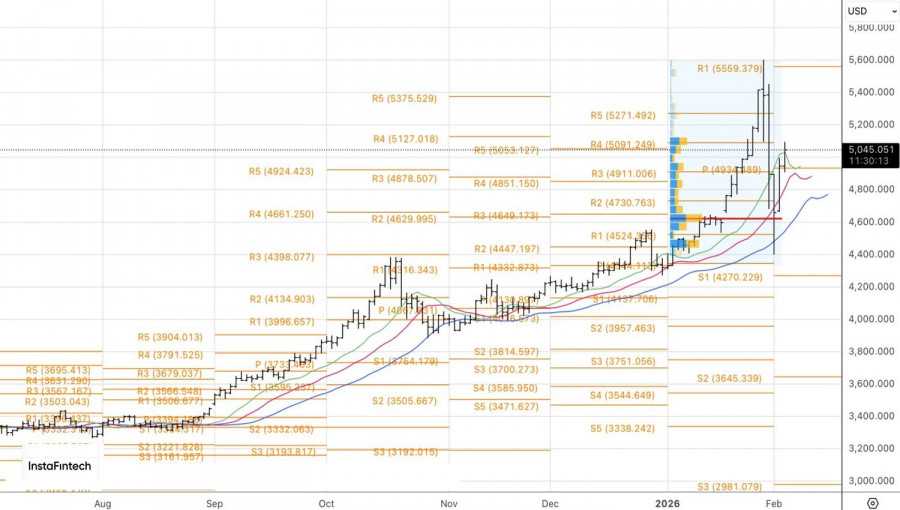

Technically, on the daily gold chart, bulls are attempting to re?establish the uptrend. A breakout of the resistance zone at $5,060–$5,080 is required for buyers to re?enter. If they succeed, XAU/USD becomes buyable again; if not, a sell signal for the metal will emerge.

RÁPIDOS ENLACES