Worrying signals from the ECB and IMF have tempered the enthusiasm of "bulls" for EUR/USD. The European Central Bank warned that pension reform in the Netherlands could bring turbulence to the European bond market. Approximately €1.9 trillion is managed by Dutch pension funds. The portfolio adjustments made by these financial institutions will affect bond yields. The International Monetary Fund raised its GDP growth forecast for Germany to 1% in 2026 and to 1.5% in 2027, but warned that without reforms, fiscal stimuli would be ineffective.

The path upwards for EUR/USD will be bumpy. According to Deutsche Bank, the major currency pair will rise to 1.25 by the end of 2026, driven by improved global GDP prospects, a cyclical upswing in Europe led by Germany, and the conclusion of the armed conflict in Ukraine. Increased confidence in the euro and its share of central banks' foreign exchange reserves will support this growth.

The rising popularity of the euro may be linked to a growing distrust of the US dollar. The story about the potential appointment of National Economic Council Director Kevin Hassett as Fed chair suggests the central bank may dance to the White House's tune, especially since the main favorite has stated that he is ready to serve the president. The more "doves" there are within the FOMC, the lower the federal funds rate is likely to fall, which is bad for the greenback.

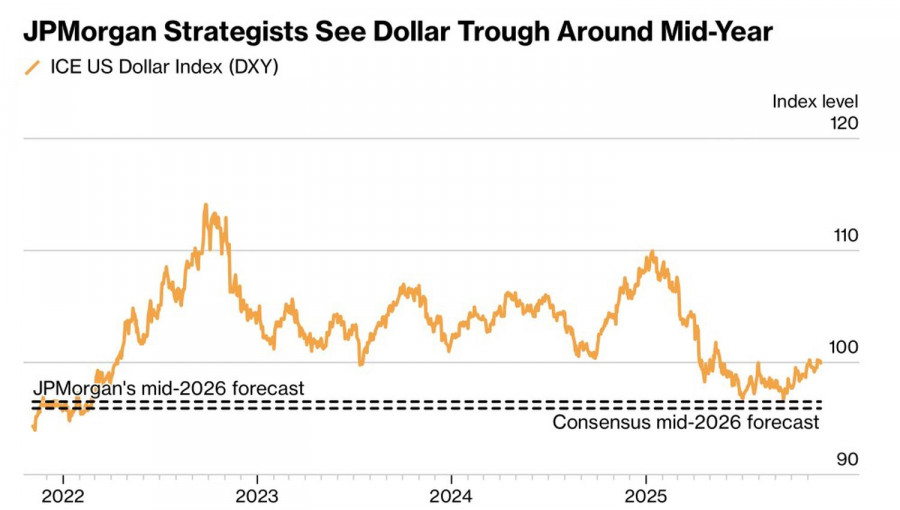

JP Morgan paints a "bearish" outlook for the USD index and presents a forecast close to the consensus of Bloomberg experts. However, the bank highlights several factors that could allow it to shift to the "bullish" side.

First and foremost, the strength of the US economy is discussed. Its vigorous growth could spark rumors of a Fed tightening of monetary policy. Even if the federal funds rate remains unchanged, it will remain higher than in other developed countries. This will occasionally allow carry traders to buy the US dollar. At the same time, US-issued assets will appear more attractive, and capital inflows into the US will support the USD index.

Additionally, JP Morgan notes that the consensus on the US dollar for 2026 is excessively "bearish." This could result in its strengthening if things do not go as expected. Similarly, the US dollar entered 2025 as the favorite due to Donald Trump's victory; however, Independence Day made it an outsider.

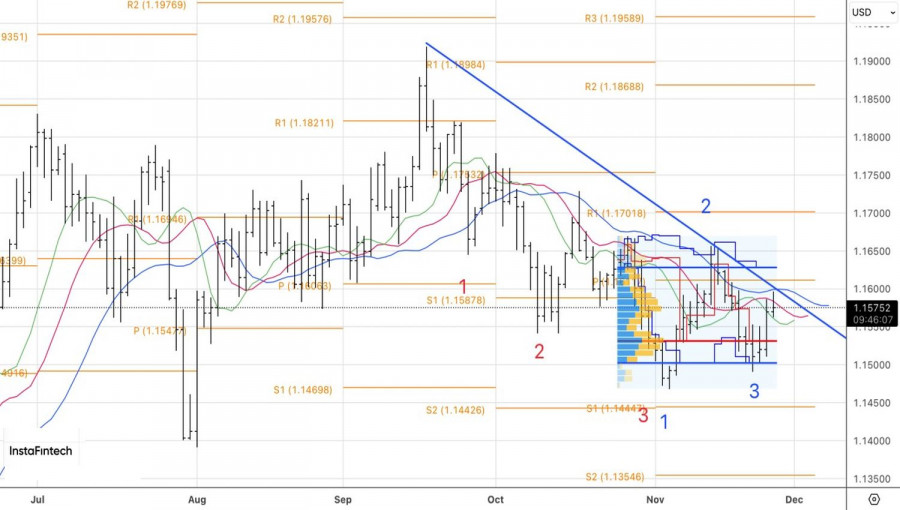

Technically, on the daily chart for EUR/USD, the "bulls" have come within arm's reach of the trendline. Successfully breaching it would activate the 1-2-3 pattern and provide a foundation for increasing long positions in the euro against the US dollar, as it, formed from 1.1535. Conversely, a rebound from resistance would increase the risks of a consolidation phase.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-11-27 02:14:00 IP: 216.73.216.14