Společnost Monness, Crespi, Hardt snížila hodnocení akcií Fiserv (NYSE:FI) na Sell z Neutral a Mastercard (NYSE:MA) na Neutral z Buy kvůli obavám z bohatého ocenění, potenciálnímu snížení násobku a rostoucí citlivosti na zpomalující se růst objemu plateb. Analytik vidí rostoucí rizika pro násobky s rostoucí makro nejistotou.

Firma přiřadila společnosti Fiserv cílovou cenu 145 USD a varovala, že očekávání investorů, zejména pro její jednotku Clover point-of-sale, se zdají být příliš vysoká na pozadí oslabujících spotřebitelských trendů a zmírňujících se diskrečních výdajů.

Ačkoli jsou Fiserv i Mastercard považovány za vysoce kvalitní společnosti se silnou návratností investovaného kapitálu, Monness argumentoval, že makroprostředí by mohlo snížit valuační prémie, kterým se tyto společnosti těší.

V případě společnosti Mastercard Monness uvedl, že její vysoký násobek zisku, který se v současné době pohybuje na 82. percentilu odhadů zisku na akcii v příštích dvanácti měsících (NTM), je zranitelný vůči snížení v prostředí zpomalujícího se makroekonomického vývoje.

Upozornili, že i v případě, že by nedošlo k výrazným revizím odhadů, by návrat k mediánu historických násobků znamenal cenu akcie kolem 400 USD.

Analytici očekávají, že společnost Mastercard bude více izolovaná než srovnatelná společnost Visa (NYSE:V) díky svému zaměření na služby s přidanou hodnotou, jako je tokenizace a prevence podvodů.

While President Donald Trump continues playing his favorite game called "Make America Great Again," market participants are calculating the cost of U.S. trade wars with nearly the entire world, for both themselves and the global economy.

Today, market focus will be on the release of key U.S. consumer inflation data, which is expected to show increases in both monthly and yearly terms, in both headline and core figures.

According to the consensus forecast, year-over-year inflation is expected to rise to 2.6% from 2.4%, with core inflation also climbing to 3.0% from 2.8%. On a monthly basis, both headline and core CPI are projected to increase by 0.3% in June, compared to 0.1% in May.

What do these figures suggest?

They point to the fact that the erratic, back-and-forth policy course demonstrated by the 47th president is leading nowhere good. As decades-long trade relationships are dismantled, transaction costs are rising, along with prices for final goods imported into the U.S. Moreover, it remains unclear who will manufacture all the necessary products domestically, given the lack of a robust industrial base for producing a wide range of goods like clothing and footwear. Executives of major U.S. corporations have already said they are unable to manufacture domestically the products currently made abroad for them. Therefore, Trump's aggressive tactics against trade partners are unlikely to yield meaningful results. Yes, some countries unable to resist U.S. pressure might give in—but ultimately, the harsh trading conditions will force them to seek alternative markets.

Under such circumstances, inflation has room for sustainable growth. This would prevent the Federal Reserve—at least while it is still led by Jerome Powell—from resuming interest rate cuts, something Trump has been eagerly pushing for. In this context, the U.S. dollar may continue to rise gradually on the Forex market, supported by the increasingly unlikely prospect of rate cuts this year. The situation could change only if the president manages to replace the Fed Chair with someone more compliant, willing to ignore the decades-old 2% inflation target. But if that happens, the U.S. could return to much higher inflation levels, similar to those seen in the 1980s.

What can be expected in the markets?

If the consumer inflation report comes in line with or above expectations, it will likely support the dollar on the Forex market, as it would delay the likelihood of Fed rate cuts until later in the year, possibly the end of the year, rather than this fall, as previously expected.

This development could put noticeable pressure on demand for cryptocurrencies traded against the dollar, and have a short-term negative effect on demand for company stocks. In such a scenario, the price of gold may continue climbing toward its local high, despite a stronger dollar.

However, if the report unexpectedly shows a drop in inflationary pressure, the opposite market reaction can be expected.

The pair is trading below the resistance level of 1.3700. A breakout of this level—driven by continued dollar strength due to Trump's tariff policies toward Canada—could push the pair toward 1.3800. A potential buy entry level is around 1.3711.

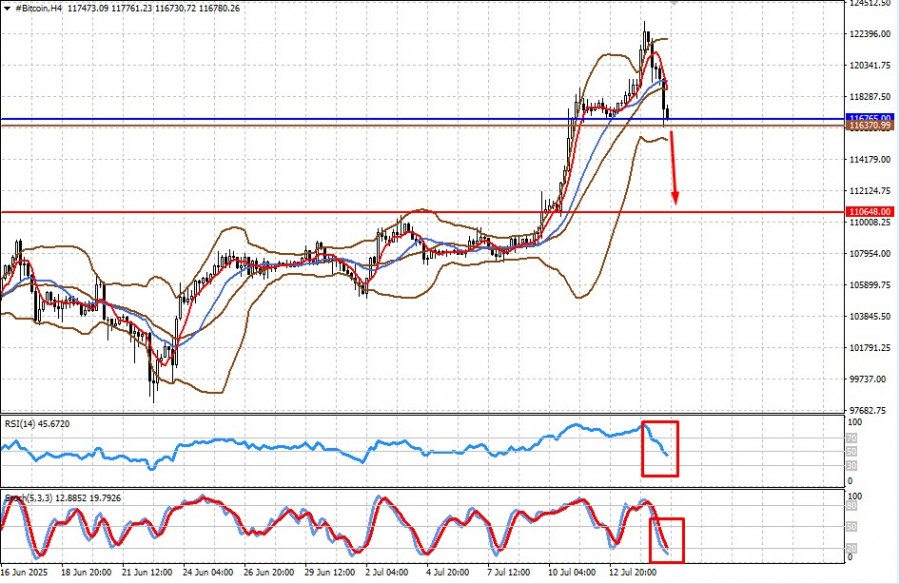

The token is under strong pressure amid expectations of rising U.S. inflation and, consequently, a stronger dollar. Against this backdrop, Bitcoin could fall to 110,648.00 after breaking the support level at 116,765.00. A potential sell entry level is around 116,370.99.

QUICK LINKS