Gedung Putih dan calon ketua Fed, Kevin Warsh, yakin bahwa bahkan dalam ekonomi yang kuat, inflasi dapat tetap rendah. Namun, apakah perlambatan inflasi konsumen merupakan tanda dari PDB yang kuat? Para investor tidak yakin. Itu sebabnya penurunan inflasi di Prancis ke level terendah dalam lima tahun menjadi katalis untuk penjualan EUR/USD.

Dinamika inflasi di Prancis

Pada akhir Januari, pasar bertanya-tanya apakah ECB akan "menghentikan" penguatan euro pada pertemuan Dewan Pemerintahan pada 5 Februari. Argumennya adalah semakin tinggi nilai mata uang, semakin besar kemungkinan inflasi melambat. Jelas itu bukan rencana Christine Lagarde dan rekan-rekannya. Meskipun penurunan EUR/USD mungkin sedikit menenangkan mereka, perlambatan pertumbuhan CPI Prancis hanya menambah masalah mereka. Jangan sampai ECB melanjutkan siklus pelonggaran moneter — itu akan menjadi kabar buruk bagi mata uang tunggal Eropa.

Ini akan sangat buruk saat kepercayaan kembali ke dolar AS. Pencalonan Kevin Warsh sebagai ketua Fed mengguncang pasar keuangan. Logam mulia paling menderita, setelah sebelumnya mendapatkan kekuatan dari ketakutan bahwa independensi Fed akan terganggu dan dari kekhawatiran terhadap hilangnya kepercayaan pada mata uang AS.

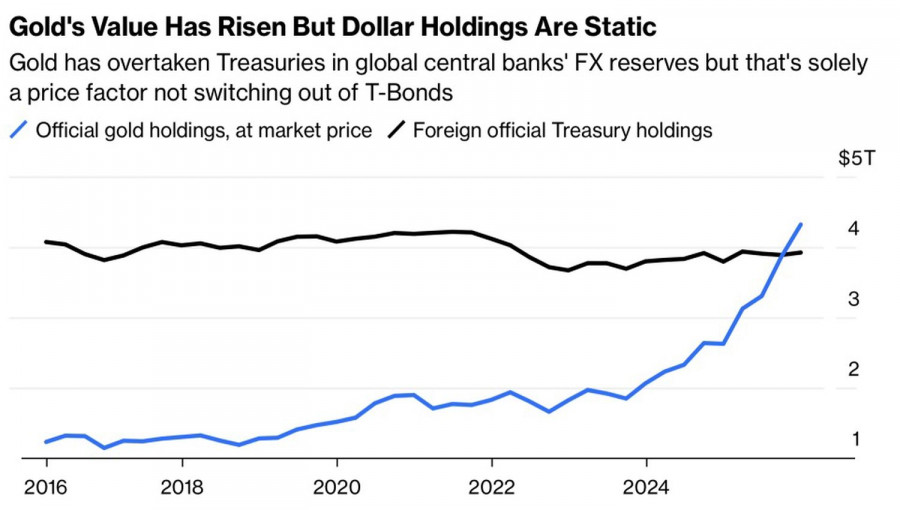

Diversifikasi cadangan resmi berlangsung begitu cepat sehingga nilai bagian emas melebihi bagian US Treasuries — dan likuiditas instrumen-instrumen ini tidak dapat dibandingkan.

Bagian emas vs. US Treasuries dalam cadangan bank sentral

Menurut pandangan Warsh, penyebab utama inflasi adalah membengkaknya neraca Fed, yang menyediakan likuiditas murah besar-besaran untuk aset berisiko dan melonggarkan kondisi keuangan. Kenaikan harga emas pada bulan Januari memiliki karakter spekulatif yang jelas — harga melonjak lebih cepat daripada sebelumnya — sehingga pengurangan neraca membantu meletuskan gelembung logam mulia tersebut.

Pertanyaannya adalah ke mana uang itu akan pergi. Bitcoin tidak banyak mendapat keuntungan dari penurunan harga emas. Saham-saham AS mendekati rekor tertinggi dan tampak dinilai terlalu tinggi berdasarkan fundamental. Obligasi menghadapi risiko ganda: pengurangan neraca meningkatkan pasokan, menurunkan harga, dan menaikkan imbal hasil, sementara pemotongan tajam suku bunga federal funds akan memiliki efek sebaliknya.

Akibatnya, yang paling diuntungkan dari Kevin Warsh sebagai ketua Fed adalah dolar AS. Bagaimana dengan keinginan Donald Trump untuk melemahkan dolar guna meningkatkan daya saing perusahaan? Saya yakin bahwa koordinasi yang lebih erat antara Federal Reserve dan Departemen Keuangan akan meningkatkan risiko intervensi mata uang. Jadi, menumpuk dolar AS berisiko — semuanya harus dilakukan dengan moderasi.

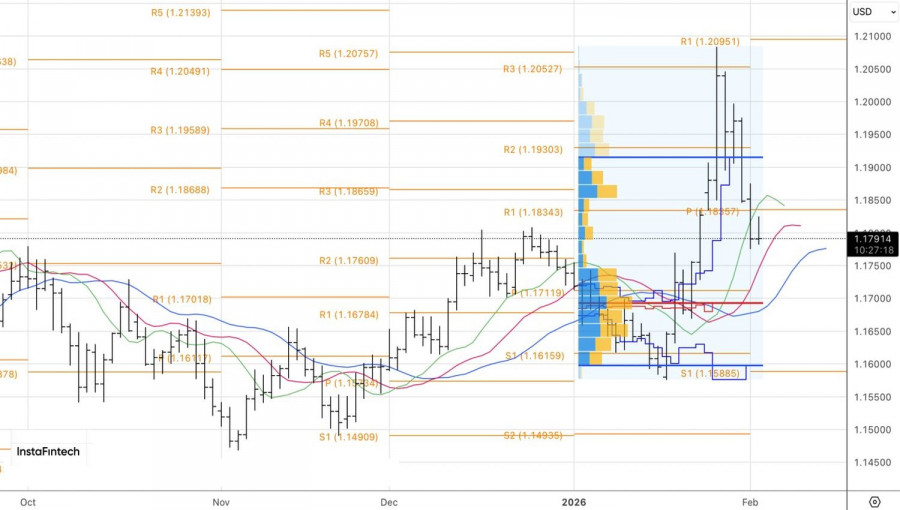

Secara teknis, grafik harian EUR/USD menunjukkan penurunan yang berkepanjangan. Posisi jual yang dibuka dari 1,1905 berhasil ditambahkan saat menembus 1,1835, yang sekarang menjadi resistance kunci.

TAUTAN CEPAT