On Friday, the EUR/USD pair continued its decline, breaking below the 127.2% Fibonacci corrective level at 1.0255. On Monday, the downward movement persisted overnight, heading toward the next Fibonacci level at 161.8% — 1.0154, which bears could reach in the next couple of days. Bulls still have no response. There was hope for weak U.S. labor market data on Friday, but those hopes were dashed.

The wave structure remains clear. The last completed upward wave failed to break the peak of the previous wave, while the new downward wave has already broken the last low twice. Thus, the bearish trend continues, with no signs of reversal. To signal a reversal, the euro would need to rise confidently above the 1.0460 level and close above it, which seems unlikely in the near future.

Friday's fundamental backdrop was very strong, but once again, it favored the bears. The two most important reports for all traders — the unemployment rate and Nonfarm Payrolls — exceeded expectations, triggering a new wave of bearish attacks (or dollar bull buying). Nonfarm Payrolls showed a December increase of 256K, much higher than traders anticipated, and the unemployment rate dropped to 4.1%, which was also unexpected. As a result, the dollar continues to rise, and bears maintain their momentum, with dollar purchases persisting even into Monday. The euro has already lost another 30 points today, and the day is just beginning, with the European session only recently underway. The bearish trend remains intact, bulls are extremely weak, and the dollar could continue to strengthen. The 4-hour chart shows a well-defined downward channel, clearly reflecting the market's bearish sentiment. The pair can continue to fall indefinitely, as there are no clear levels where the decline must stop.

On the 4-hour chart, the pair rebounded twice from the 127.2% Fibonacci corrective level at 1.0436 and broke below 1.0332. As a result, the decline may continue if bears can push below the 161.8% level at 1.0225 today. In this case, the target would shift to 1.0110. The downward trend channel clearly reflects the market's sentiment, and without a breakout above it, significant euro growth is unlikely. No emerging divergences are observed today.

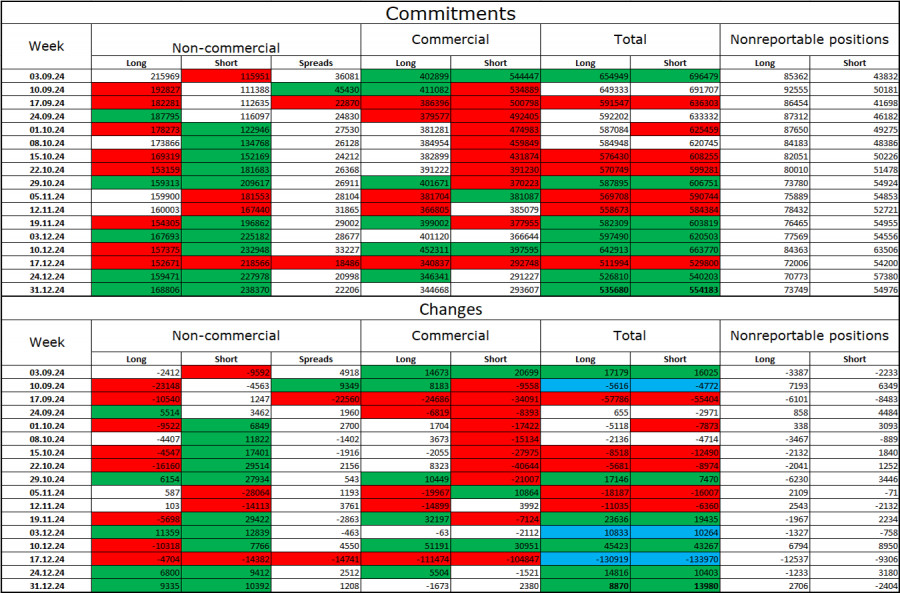

In the latest reporting week, speculators added 9,335 long positions and 10,392 short positions. The sentiment of the "Non-commercial" group remains bearish and is strengthening, signaling further declines for the pair. The total number of long positions held by speculators is now 168,000, while short positions total 238,000.

For 16 consecutive weeks, large players have been offloading the euro. This unequivocally confirms the bearish trend. While bulls occasionally dominate during certain weeks, these instances are exceptions. The key factor driving the dollar's rise — expectations of FOMC monetary policy easing — has already played out. With no new reasons to sell the dollar, its growth remains more likely. Chart analysis also supports the continuation of the long-term bearish trend. Thus, I anticipate a prolonged decline in the EUR/USD pair.

The economic calendar for January 13 does not feature any significant entries. The fundamental backdrop is expected to have no impact on market sentiment today.

Fibonacci Levels: