Investors only need an excuse to sell tech stocks. The White House statement that NVIDIA must comply with new security rules for AI chip sales to China — together with Florida's new consumer protection rules for AI — acted as a catalyst for the Nasdaq Composite's pullback. The S&P 500 recorded a two?day decline.

We no longer need the Magnificent Seven to move markets. Tech stocks are no longer the safe haven they seemed after the COVID?19 pandemic — that's a refrain you hear more and more from investors. That rotation has driven small?cap indices such as the Russell 2000 to outperform the S&P 500 for nine consecutive days, notching the longest streak since 1990.

US Equity Dynamics

Banks also contributed to the S&P 500's slide. Wells Fargo's earnings per share disappointed, Bank of America's 12% quarterly profit growth failed to satisfy investors, and Citi's $1.2bn charge related to winding down operations in Russia spooked the market. Corporate earnings estimates for the broad index look stretched for Q4, increasing the risk of a sharper correction.

US macroeconomic data did not help the S&P 500. Retail sales rose by 0.6% in November, and producer prices slowed to 0.2% month?on?month. The data justify the Fed's wait-and-see approach for now. The futures market is pricing a resumption of easing only around June. Until then, the S&P 500 is effectively without a safety cushion.

Geopolitics is also on investors' minds. Markets are sensitive to the so?called "Donro" doctrine — or Donald Trump's intent to dominate the Western Hemisphere. His pressure on Venezuela and Iran risks upsetting China, a major buyer of oil from those countries. White House claims on Greenland could prompt Beijing to turn up pressure on Taiwan. Tech firms would be among the main casualties: NVIDIA, for example, gets roughly 16% of its revenue from Taiwan.

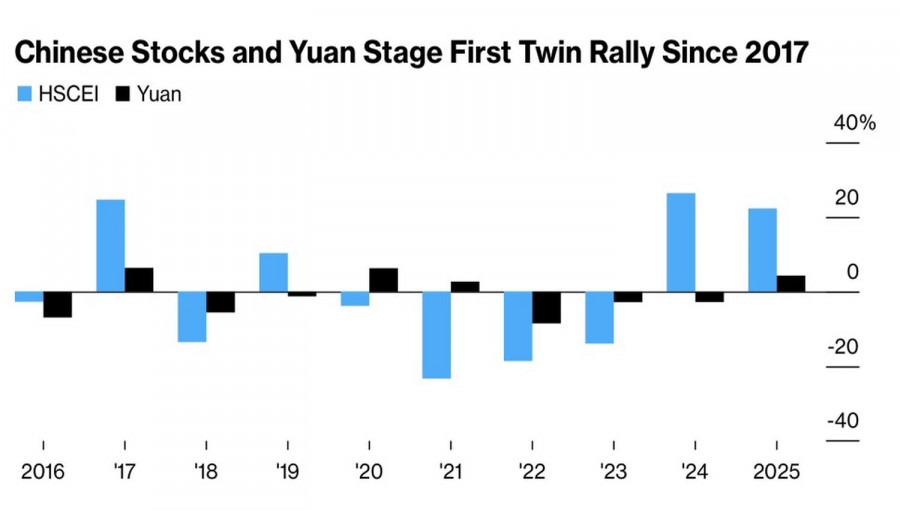

Shanghai Composite and Yuan Dynamics

China can also ruin the mood in US equity markets in other ways. The rotation is not only from tech giants to US?sensitive cyclicals — capital is flowing out of the United States and into other markets, which puts additional pressure on the S&P 500.

China looks attractive. Goldman Sachs raised its target for the Shanghai Composite to 5,200 by end?2026, implying roughly a 9% rally. The bank expects local corporate profits to accelerate from about 4% in 2025 to stronger growth in 2026–2027.

Turning to the technical outlook for the S&P 500, the daily chart shows the formation of a bar with a long lower shadow. A return to that bar's high at 6,840 would be a buy signal. Conversely, a drop below the fair?value level at 6,905 would be a reason to sell.