Airbus v květnu dodal přibližně 51 letadel, uvedly zdroje z odvětví, což představuje pokles o 4 % oproti stejnému měsíci loňského roku.

Celkový počet dodávek za letošní rok tak dosáhl přibližně 243 letadel, což je o 5 % méně než za prvních pět měsíců roku 2024.

Airbus se před zveřejněním měsíční zprávy o výsledcích, které je plánováno na 5. června, odmítl vyjádřit.

Největší světový výrobce letadel čelí rostoucímu tlaku leteckých společností kvůli zpožděním dodávek, protože si klade za cíl zvýšit počet dodávek zákazníkům za celý rok o 7 % na 820 letadel.

Letecké společnosti, které se tento týden sešly na svém výročním zasedání v Novém Dillí, kritizovaly výrobce za dodavatelské problémy, které přetrvávají již několik let od začátku pandemie. Šéf saudskoarabské nízkonákladové letecké společnosti flyadeal označil zpoždění za „neomluvitelné“.

Airbus uvedl, že očekává, že zpoždění, způsobená částečně pomalými dodávkami motorů, se během léta stabilizují.

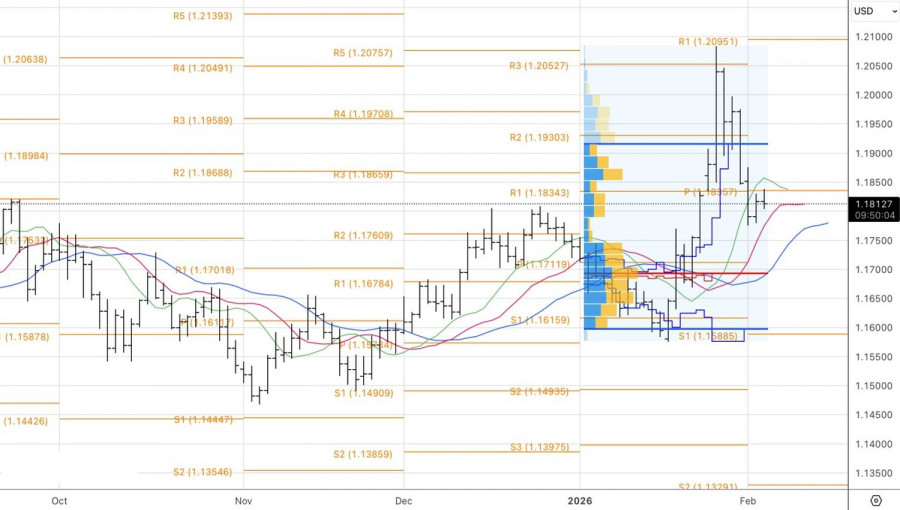

Victory eludes the ECB. In the second half of 2025, Christine Lagarde confidently claimed that inflation in the Eurozone had been tamed. It seemed that consumer prices were indeed anchored near the 2% mark. This allowed investors to speculate about the end of the monetary easing cycle and a potential increase in the deposit rate by the end of 2026. As a result, bulls on EUR/USD entered the new year with optimism. However, the reality has proven to be less rosy than anticipated.

Geopolitical factors, Donald Trump's tariff threats, and the strengthening of the euro in 2025 and early 2026 contributed to a slowdown in consumer prices in the Eurozone to 1.7% in December. This is the lowest level since September 2024. The growth rate of core inflation dropped to 2.2%—its lowest since October 2021. Such trends are likely to revive discussions about rate cuts after a lengthy pause following the five previous ECB meetings.

Whether the European Central Bank's inflation forecasts come to fruition will depend on the dynamics of EUR/USD. The surge in the main currency pair towards 1.21 prompted several Governing Council officials to utilize verbal interventions. By the time of the February meeting, the situation had stabilized, but the risks had not disappeared.

One key risk is Kevin Warsh's potential appointment as Fed chairman. The former FOMC official, appointed by Donald Trump, must be confirmed by Congress. He has seriously discussed lowering rates and is confident that inflation in the high-performing US economy will likely slow.

However, economists argue that the very idea of decreasing consumer price growth through easing monetary policy is absurd. This was seen in Turkey, where President Recep Tayyip Erdogan, who controls the central bank, forced rate cuts under the pretense of combating speculators driving up interest rates and, in turn, inflation. The result is well-known: a currency crisis, a collapse of the lira, and double-digit CPI. Does anyone want that to happen in the US?

I believe it will be challenging to convince other FOMC officials of the need to quickly resume a cycle of monetary expansion, particularly given Warsh's frequent criticism of the Fed. His theories are merely hypotheses that require verification through data, which indicate that inflation in the US is more likely to reach 3% than to drop to 2%.

In my view, markets are gradually stabilizing, and without new antics from Donald Trump, they may revert to monetary policy. This means a long pause in the rate-cutting cycle plays into the hands of the US dollar, especially as the ECB may begin to contemplate hiking borrowing costs.

Technically, the daily chart for EUR/USD shows bulls attempting to recover an internal bar. A failure to break through and a subsequent decline to its lower boundary at 1.1775 would provide grounds for increasing shorts. Purchases should be reconsidered above 1.1835.