Akcie francouzského satelitního telekomunikačního operátora Eutelsat (ETL) klesly o 5 % po oznámení změny ve vedení společnosti.

Eva Berneke, která stála v čele společnosti dva roky, odstoupí z funkce generální ředitelky.

Nástupcem Bernekeové byl oznámen Jean-François Fallacher, současný generální ředitel společnosti Orange France.

Fallacher se své nové funkce ve společnosti Eutelsat ujme od 1. června. Společnost v tuto chvíli neposkytla další podrobnosti o změně vedení.

Central banks are usually less agile than hedge funds or asset managers. However, they control enormous reserves of $12 trillion. If they begin diversifying by selling one currency and buying another, the consequences for Forex could be massive. In this regard, the reduction of the U.S. dollar's share in foreign exchange reserves to 56.3%—the lowest level since 1995—has seriously alarmed EUR/USD bears. Could the process of offloading the greenback already be underway?

Dynamics of the U.S. Dollar's Share in Central Bank Reserves

There are plenty of reasons for concern. The highest tariffs since the 1930s, along with attempts by the White House to undermine the Fed's independence, are fueling hostility toward the greenback. Donald Trump's "big and beautiful" tax cut law is expanding the deficit and national debt. The president is not opposed to a weaker dollar to boost the competitiveness of U.S. companies abroad. Finally, the division of the world into West and East due to the war in Ukraine is opening the door for de-dollarization.

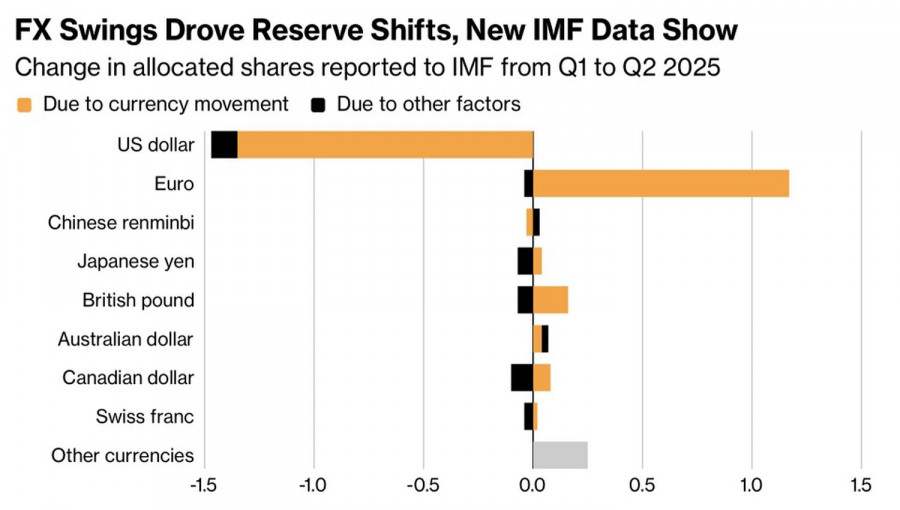

In fact, the decline in the dollar's share of reserves has been driven not by central banks abandoning it, but by exchange rate depreciation. From April to June, the U.S. dollar fell 9% against the euro, 11% against the Swiss franc, and 6% against the pound. Thanks to the EUR/USD rally, the euro's share rose to 21%, its highest since 2021.

Factors Shaping Central Bank Reserve Allocation

Thus, central banks are not yet ready to trigger tectonic shifts in the FX market. The EUR/USD uptrend is primarily the result of divergences in monetary policy between the European Central Bank and the Fed, as well as differences in economic growth. Still, the bulls are looking increasingly exhausted, making it harder to sustain momentum.

The pair is supported by the looming government shutdown and disappointing private-sector employment data from ADP. Historically, U.S. government shutdowns have led to a weaker dollar index due to fears of slower economic growth. This time could be even worse: the labor market is cooling, and Donald Trump is threatening mass layoffs of government employees.

It is no surprise that the futures market has raised the probability of a federal funds rate cut at the October FOMC meeting to 99%, and to 87% for December. If the ECB holds steady in 2025 while the Fed continues easing monetary policy, the dollar will face significant pressure, with any rebounds likely to be short-lived.

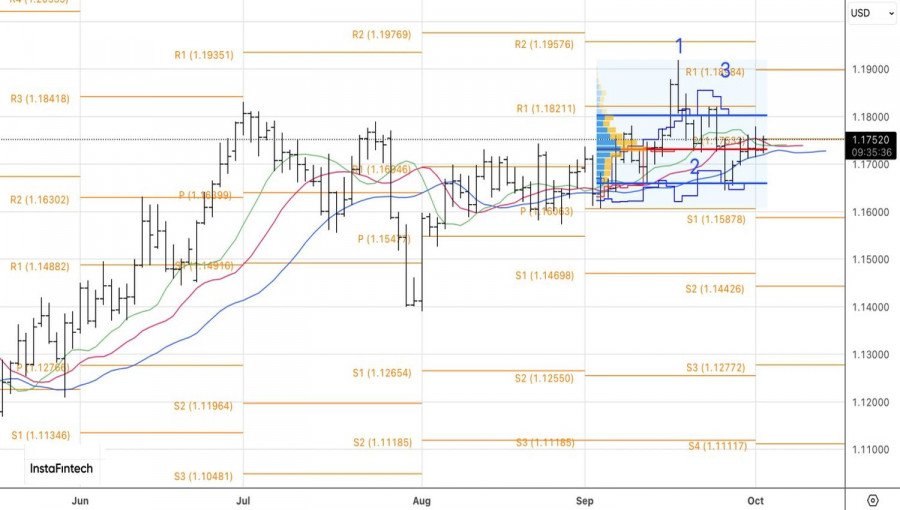

On the daily chart, EUR/USD is consolidating in the 1.1715–1.1785 range. A break below the lower boundary would increase the risk of a pullback toward 1.16 and justify short positions. Conversely, a decisive breakout above 1.1755 and 1.1785 would be a signal to add to long positions.